The Duties of an Executor

An executor is an individual or institution that is named in a will whose duty is to distribute estate assets according to the testator’s wishes. Acting as an executor can be stressful and time consuming so it is a good…

An executor is an individual or institution that is named in a will whose duty is to distribute estate assets according to the testator’s wishes. Acting as an executor can be stressful and time consuming so it is a good…

Debt today is so common, you might say it can’t be avoided. Most people are not in a position to purchase a house or car for cash, while those who can buy such things outright may prefer to finance and…

Have you found yourself wondering if you really need that life insurance policy you pay for every month? You are not alone. As time goes on we often forget the reasons behind purchasing the amount and type of coverage we…

If you have ever thought that life insurance was something you wouldn’t need after you reached a certain level of financial security, you might be interested in knowing why many wealthy individuals still carry large amounts of insurance. Consider the…

Whether you are decades away from retirement or if it is just around the corner, being aware of the planning opportunities will take the fear and uncertainty out of this major life event. Blue sky your retirement plans to get…

On Friday, February 19, 2021, Prime Minister Justin Trudeau announced an extension to:

– Canada Recovery Benefit

– Canada Recovery Caregiving Benefit

– Canada Recovery Sickness Benefit

– Employment Insurance

Great news for some ineligible self-employed Canadians who received the Canada Emergency Response Benefit (CERB)

For the 2020 tax year, the Government of Canada introduced a temporary flat rate method to allow Canadians working from home this year due to Covid-19 to claim expenses of up to $400.

Finance Minister Chrystia Freeland recently provided the government’s fall economic update. It included information on the government’s strategy for dealing with the COVID-19 pandemic and its plan to help shape the recovery. We’ve summarized the highlights for you:

• Corporate Tax Changes, including extensions to subsidy programs.

• Personal Tax Changes, including additional Canada Child Benefit Plan payments and a new “Work from home” tax credit.

• Indirect Tax Changes, including the proposal to charge GST/HST on services provided via digital platforms, as well as the temporary removal of GST/HST on face masks and shields.

For business owners, as of December 4th, the CEBA loan has been expanded by an additional $20,000.

The new Canada Emergency Rent Subsidy is open for applications today! Unlike the previous program, this subsidy will provide payments directly to qualifying renters and property owners, without requiring the participation of landlords.

CERS covers up to 65% of rent for businesses, charities and non-profits impacted by COVID-19.

An additional 25% Lockdown Support is available during a public health lockdown order.

The Canada Recovery Benefit (CRB) is now open for applications.

If you are eligible for the CRB, you can receive $1,000 ($900 after taxes withheld) for a 2-week period.

If your situation continues past 2 weeks, you will need to apply again. You may apply up to a total of 13 eligibility periods (26 weeks) between September 27, 2020 and September 25, 2021.

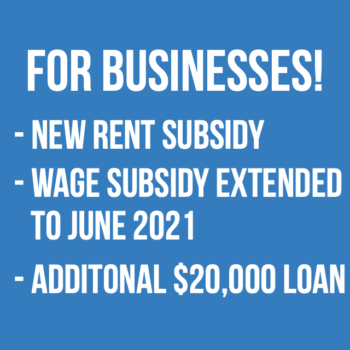

Great news for businesses! The new Canada Emergency Rent Subsidy will be available directly to business owners who need rent relief. The Wage Subsidy has been extended to June 2021. And the CEBA has been expanded to provide up to $20,000 interest-free loan.

Starting October 5, 2020, the Government of Canada will be accepting online applications for the Canada Recovery Sickness Benefit (CRSB) and the Canada Recovery Caregiving Benefit (CRCB).

On September 23rd, in a speech delivered by Governor General Julie Payette, Prime Minister Justin Trudeau outlined the Federal government’s priorities.

On August 31st, Deputy Prime Minister and Minister of Finance Chrystia Freeland announced the extension of the Canada Emergency Business Account (CEBA) to October 31st, 2020. This will give small businesses 2 additional months to apply for the $40,000 loan.

In addition, the Federal Government said it was working with financial institutions to make the CEBA program available to those with qualifying payroll or non-deferrable expenses that have so far been unable to apply due to not operating from a business banking account.

5705 Cancross Ct Suite 200

Mississauga, Ontario

L5R 3E9

625 Cochrane Drive Suite 610

Markham, Ontario

L3R 9R9